Fascination About Hsmb Advisory Llc

Fascination About Hsmb Advisory Llc

Blog Article

Things about Hsmb Advisory Llc

Table of ContentsHsmb Advisory Llc - An OverviewHsmb Advisory Llc Things To Know Before You BuyAn Unbiased View of Hsmb Advisory LlcAbout Hsmb Advisory LlcThe Hsmb Advisory Llc DiariesThe Best Strategy To Use For Hsmb Advisory Llc

Ford says to avoid "cash money worth or long-term" life insurance policy, which is more of a financial investment than an insurance policy. "Those are very complicated, featured high commissions, and 9 out of 10 people do not need them. They're oversold because insurance representatives make the largest payments on these," he claims.

Handicap insurance can be costly. And for those who choose for lasting treatment insurance, this policy may make handicap insurance unneeded. Learn more concerning long-lasting treatment insurance policy and whether it's best for you in the next area. Long-lasting care insurance policy can aid spend for expenditures related to lasting care as we age.

Top Guidelines Of Hsmb Advisory Llc

If you have a persistent health worry, this kind of insurance can wind up being critical (Health Insurance). Nonetheless, do not allow it worry you or your savings account early in lifeit's generally best to secure a plan in your 50s or 60s with the expectancy that you will not be utilizing it up until your 70s or later.

If you're a small-business owner, think about safeguarding your source of income by buying business insurance policy. In the event of a disaster-related closure or duration of rebuilding, business insurance policy can cover your earnings loss. Think about if a considerable weather occasion influenced your storefront or production facilityhow would certainly that impact your revenue?

And also, utilizing insurance policy might occasionally cost greater than it saves over time. For instance, if you get a contribute your windshield, you may think about covering the repair work cost with your emergency financial savings rather of your vehicle insurance policy. Why? Because using your vehicle insurance can cause your monthly premium to increase.

What Does Hsmb Advisory Llc Mean?

Share these pointers to shield enjoyed ones from being both underinsured and overinsuredand talk to a trusted expert when required. (https://fliphtml5.com/homepage/nntoi/hsmbadvisory/)

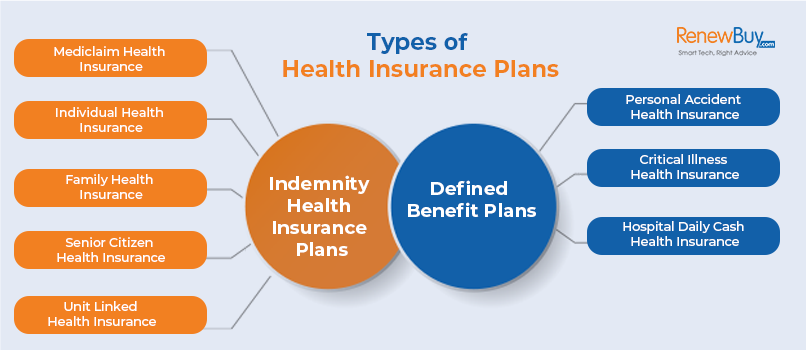

Insurance that is purchased by a private for single-person insurance coverage or protection of a family members. The private pays the premium, in contrast to employer-based wellness insurance policy where the employer often pays a share of the premium. People may purchase and acquisition insurance coverage from browse this site any kind of plans offered in the person's geographic area.

People and families might certify for economic help to reduce the price of insurance premiums and out-of-pocket expenses, yet just when enrolling with Attach for Health Colorado. If you experience particular modifications in your life,, you are eligible for a 60-day period of time where you can enlist in a private plan, also if it is outside of the yearly open enrollment period of Nov.

15.

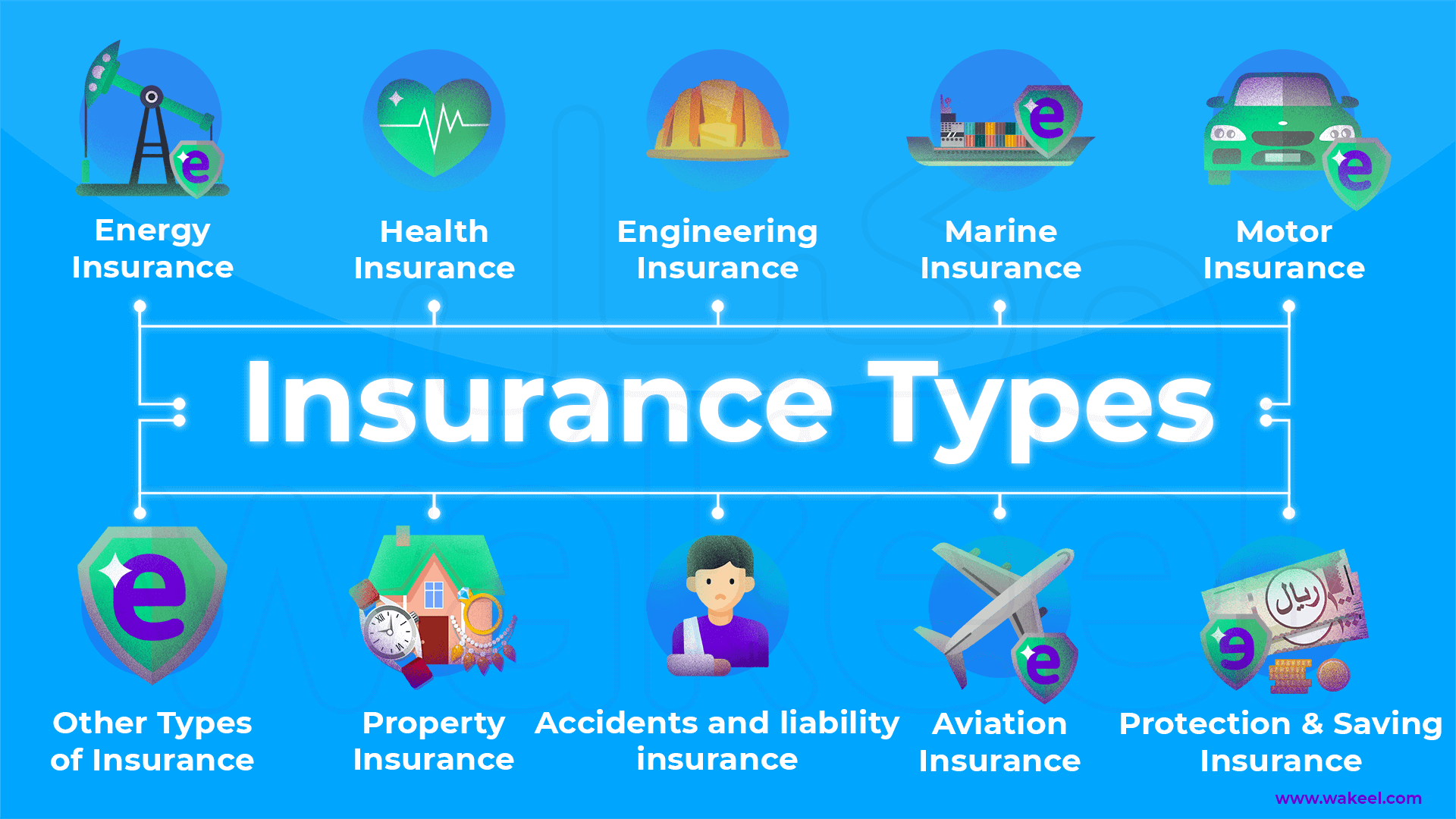

It might seem easy however comprehending insurance coverage kinds can also be confusing. Much of this confusion comes from the insurance policy market's continuous goal to make tailored coverage for insurance holders. In developing adaptable policies, there are a range to pick fromand all of those insurance coverage kinds can make it difficult to comprehend what a particular plan is and does.

Excitement About Hsmb Advisory Llc

The very best area to begin is to chat regarding the distinction in between both kinds of fundamental life insurance coverage: term life insurance policy and permanent life insurance policy. Term life insurance policy is life insurance coverage that is just active temporarily duration. If you pass away during this period, the person or individuals you have actually named as recipients might get the money payment of the policy.

However, lots of term life insurance policy plans allow you transform them to a whole life insurance plan, so you do not lose protection. Usually, term life insurance policy policy costs settlements (what you pay monthly or year into your policy) are not secured at the time of acquisition, so every five or ten years you own the plan, your costs can rise.

They also tend to be less expensive general than entire life, unless you acquire a whole life insurance policy policy when you're young. There are also a few variants on term life insurance policy. One, called team term life insurance, is typical amongst insurance policy alternatives you could have accessibility to with your company.

The Single Strategy To Use For Hsmb Advisory Llc

One more variant that you might have access to with your company is additional life insurance., or burial insuranceadditional coverage that might assist your family in situation something unanticipated happens to you.

Long-term life insurance policy merely refers to any kind of life insurance policy plan that does not expire. There are numerous sorts of long-term life insurancethe most usual kinds being whole life insurance policy and universal life insurance coverage. Entire life insurance is precisely what it seems like: life insurance policy for your entire life that pays out to your recipients when you pass away.

Report this page